Earn-outs, explained

- Sep 24, 2025

- 4 min read

When you're selling a business, agreeing the price isn’t always simple. That’s especially true if your business has big growth potential, but isn’t quite there yet.

That’s where an earn-out can come in.

It’s a way to bridge the gap between what a buyer is willing to pay today, and what the seller believes the business could be worth in the future. Here’s how they work, why they matter, and what to watch out for.

What’s an earn-out?

An earn-out is a way of structuring the purchase price in a business sale.

Instead of paying everything up front, the buyer pays part of the price later; but only if the business hits certain performance targets after completion. These payments are usually based on profits, revenue, or other KPIs over one to three years.

Think of it like this:

You get a fixed payment now.

You get more later – but only if the business performs as agreed.

So the total sale price becomes partly guaranteed, partly conditional.

Why do earn-outs exist?

Earn-outs are most often used when:

The buyer and seller can’t agree on value. Maybe the seller is optimistic about future growth, while the buyer is sceptical.

The business is early-stage or high-growth. A strong pipeline or recent product launch might justify a higher price, but only if the expected results follow.

The buyer wants to de-risk. They don’t want to overpay, especially if funding is tight or the sector is volatile.

The seller is staying on. If the founders or senior team are continuing post-sale, an earn-out can keep them motivated.

In short, they help deals happen when there’s uncertainty or disagreement about what the business is really worth.

What’s the catch?

While earn-outs sound fair in theory, they’re one of the most common causes of post-deal disputes.

Here’s why:

1. You don’t get a clean break

If you're selling but staying on, your involvement post-sale becomes critical. You might end up under pressure to hit targets, but with limited control if you're no longer in charge.

2. Conflicting incentives

Buyers might cut costs, restructure, or make decisions that lower profits (and your earn-out). Sellers might be tempted to maximise short-term gains, even if it hurts long-term performance.

3. Complex accounting

Small tweaks in accounting methods can have a big impact on how performance is measured. It takes careful drafting to avoid manipulation or confusion.

4. Tax traps

If structured badly, the seller could be taxed on money they never receive – especially if the earn-out is treated as capital gain upfront.

A simple example

Let’s say you agree to sell your business for £3 million, made up of:

£2 million on completion

£1 million earn-out over two years, based on hitting profit targets

If the business hits its profit targets, you get the full £3 million. If it underperforms, you might only get £2.2 million (or nothing more at all).

How are earn-outs structured?

There’s no standard formula, but most earn-outs involve:

A defined earn-out period

Usually 1–3 years after completion.

Clear performance metrics

These might include:

Net profit

EBITDA

Turnover/revenue

Number of new customers

Operational targets (like product launches or client wins) are sometimes used too.

Agreed calculation method

This means defining accounting policies in detail. For example, will overheads from the wider group be allocated to the target business?

A process for disputes

Often involving independent accountants if there’s disagreement over the numbers.

Payment terms

Will payments be cash, shares, or loan notes? Will there be a minimum or cap?

Key issues to watch out for

Here are some practical things to consider if you're negotiating an earn-out:

Who controls the business post-sale?

If the buyer can make big strategic decisions, you’ll want protections in the contract to stop them from intentionally (or unintentionally) tanking the performance.

Can they sell the business during the earn-out?

If the business is flipped or broken up during your earn-out period, you might lose out. Sellers sometimes negotiate “acceleration clauses” in that scenario.

What if you leave the business?

Many earn-outs are linked to your ongoing involvement. You might be classed as a “good leaver” or “bad leaver”, with very different outcomes.

What about synergy effects?

If the business performs well only because of integration into the buyer’s group, should you still get paid? You’ll need to agree how those “synergistic gains” are treated.

Alternatives to earn-outs

If an earn-out feels risky or inappropriate, other options include:

Completion accounts: adjusting the price based on the actual financial position at completion.

Locked box: fixing the price in advance based on a recent balance sheet, with safeguards against value “leaking out” before completion.

Deferred payments: paying the balance over time, without linking it to performance.

Read more about this here Completion accounts, explained

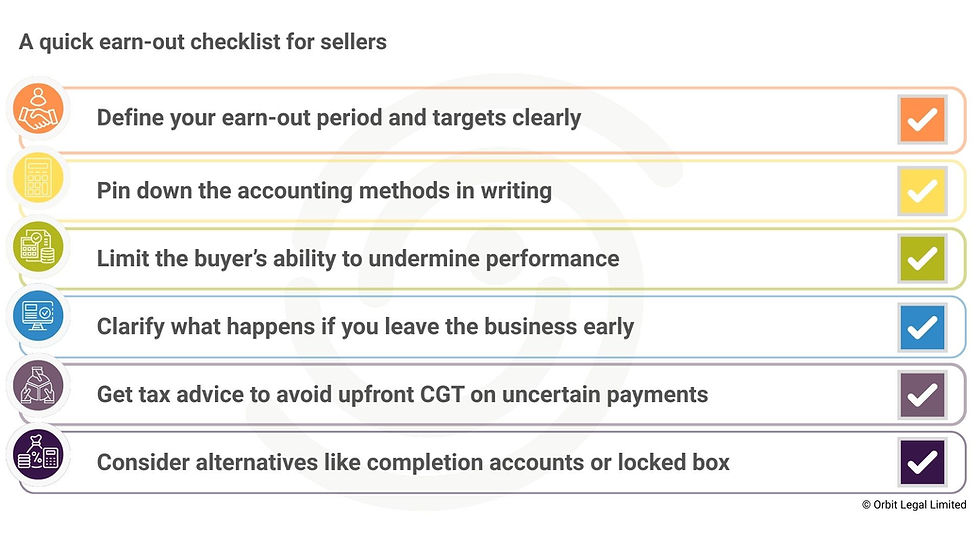

Quick checklist for sellers

Final thoughts

Earn-outs can be a helpful way to bridge valuation gaps, but they’re not right for every deal.

If you’re considering one, make sure you understand the mechanics, risks, and protections. Get legal and tax advice early, and don’t rely on handshake agreements.

To talk it through, contact us:

📩 info@orbitlegal.co.uk | 📞 0115 6777095 |

Disclaimer

This content is for general information only and doesn’t constitute legal, accounting, financial, or tax advice. It’s based on the law of England & Wales and was correct at the date of publication, but the law and guidance can change. Reading this page doesn’t create a solicitor–client relationship with Orbit Legal. Please take advice on your specific circumstances before acting. Get advice for your situation by contacting Orbit Legal at info@orbitlegal.co.uk or 0115 6777095.

Comments