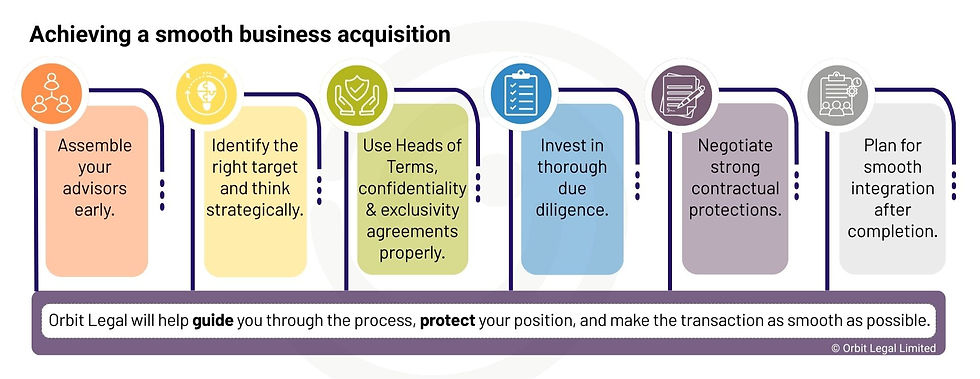

How to Buy a Business: A Step-by-Step Guide for SME Buyers

- Sep 26, 2025

- 4 min read

Buying a business can be a game-changing opportunity. Whether you’re looking to grow through acquisition, diversify into a new market, or take on an existing company rather than starting from scratch, the rewards can be significant.

But the process can feel daunting.

How do I buy a business?

What is the process for buying a business?

How long does it take?

These are some of the most common questions SME owners ask us.

This guide sets out the step-by-step process of buying a business in the UK from a buyer’s perspective. It covers everything from identifying a target to post-completion steps, and highlights the key differences between a share sale and an asset sale.

Step 1: Build Your Support Team

Before you even start looking at businesses to buy, put the right advisers around you. Buying a business involves financial, legal and tax considerations that can be difficult to manage alone.

Your advisory team will usually include:

Involving your advisers early avoids wasted time and helps you focus only on deals that are realistic and achievable. Orbit Legal often works alongside accountants and banks to provide joined-up support to buyers at every stage.

Step 2: Identify the Target Business

The first practical step is identifying the right business to buy. This might be:

A competitor offering economies of scale.

A supplier or distributor that strengthens your supply chain.

A complementary business to diversify your services.

A distressed opportunity where you can add value.

When shortlisting targets, consider:

Size and scale: Turnover, staff, assets.

Geography: Proximity to your existing operations.

Synergy: How well the business fits with your strategy.

Deal readiness: Whether the business is prepared for sale.

Think strategically. Don’t just look for what you can afford now, look for a target that strengthens your long-term position.

Step 3: Initial Contact and Negotiations

Once a target is identified, early discussions focus on:

Indicative price range.

Preferred deal structure (share or asset sale). See more here: Share Sale vs Asset Sale: A practical guide for SME buyers and sellers

Timescale for completing the transaction.

Seller motivations and conditions (e.g. do they want to stay involved for a transition period?).

Valuation approaches commonly include EBITDA multiples, net asset value, or discounted cash flows. But value doesn’t always equal price. Competitive tension, seller circumstances, and future potential all influence the final number.

Having your team involved at this stage ensures negotiations are grounded in realistic expectations and you don’t commit to terms that create issues later.

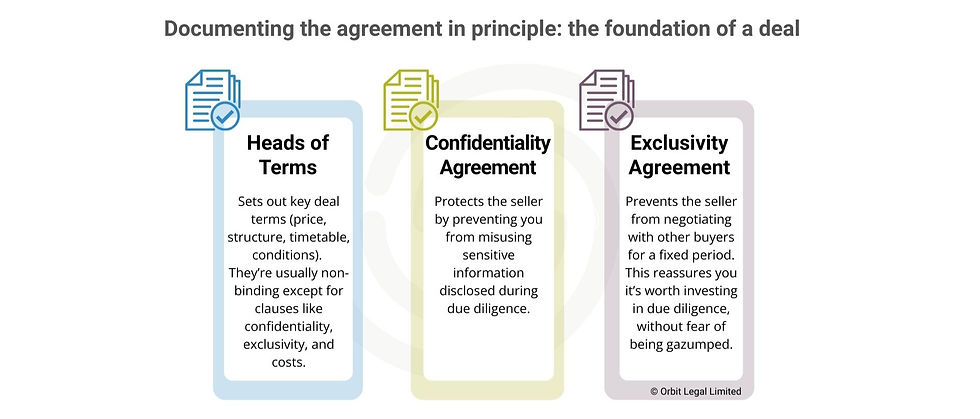

Step 4: Heads of Terms, Confidentiality & Exclusivity

Once there is broad agreement, it’s time to formalise the understanding before due diligence.

It’s vital these documents are drafted carefully. Poorly worded terms can create disputes or weaken your negotiating position later. We should review or draft them before signing.

Step 5: Due Diligence

Due diligence is your chance to lift the bonnet and see exactly what you’re buying. This stage can make or break a deal.

What you’ll be checking:

Financial: Accounts, debts, cash flow, forecasts.

Legal: Corporate records, contracts, property, employment, litigation.

Tax: Past compliance and any liabilities.

Commercial: Customers, suppliers, competitors, market trends.

Differences in due diligence between share and asset sales:

Share sale: You inherit the entire company (including hidden liabilities). Due diligence needs to be wide-ranging.

Asset sale: You only buy selected assets and liabilities. Due diligence focuses more narrowly on those items.

Don’t cut corners. A thorough due diligence process is your best protection against surprises and helps justify the price you’re paying.

Step 6: Negotiating the Main Sale Agreement

Once diligence is underway, lawyers draft the main agreement.

Share sale: Share Purchase Agreement (SPA).

Asset sale: Asset Purchase Agreement (APA).

Both agreements will cover:

Warranties: Promises made by the seller about the business (e.g. accounts accuracy, ownership of assets, absence of disputes).

Indemnities: Specific protections for known risks (e.g. pending litigation, tax liabilities).

Price mechanics: Whether the price is fixed (“locked box”) or adjusted afterwards (completion accounts). See more here: Completion Accounts vs Locked Box: What’s the right price mechanism for your deal?

Limitations: Caps, thresholds and time limits restricting seller liability.

Our role is to secure protections that give you recourse if things go wrong after completion.

Step 7: Supporting Documents

Alongside the main agreement, various ancillary documents are needed to put the deal into effect.

Asset sales often require more documentation, because each asset and contract must be transferred individually, sometimes with third-party consent.

Step 8: Completion

Completion is the point where ownership formally changes hands.

Typically:

Transaction documents are signed and exchanged.

Buyer pays the purchase price.

Shares or assets are transferred.

In a share sale, completion is usually straightforward as ownership transfers once shares are signed over. In an asset sale, completion can be more complex due to multiple transfers and consents.

Step 9: Post-Completion

The work doesn’t stop when the ink is dry. Post-completion tasks include:

Filings: Companies House (for share transfers and new directors).

Notifications: HM Revenue & Customs, regulators, landlords, suppliers, customers.

Integration: Transitioning employees, systems, and customers smoothly.

Deferred payments: Monitoring earn-outs or staged payments if part of the deal.

How Long Does It Take to Buy a Business?

SME buyers often ask: “how long does it take to buy a business?”

The answer depends on the size and complexity of the target, but for an arm’s-length deal between unconnected parties, typical timelines are:

3 months: Small, straightforward deal with cooperative parties.

6 months: Standard SME transaction.

9+ months: Larger, regulated, or complex businesses where third-party consents are required.

Asset sales often take longer than share sales due to the need for multiple individual transfers.

Common Buyer Pitfalls

Summary & Next Steps

Buying a business is a major step, but with the right team and preparation it can be transformative.

If you’re considering buying a business then let's chat through your plans:

📩 info@orbitlegal.co.uk | 📞 0115 6777095 |

Disclaimer

This content is for general information only and doesn’t constitute legal, accounting, financial, or tax advice. It’s based on the law of England & Wales and was correct at the date of publication, but the law and guidance can change. Reading this page doesn’t create a solicitor–client relationship with Orbit Legal. Please take advice on your specific circumstances before acting. Get advice for your situation by contacting Orbit Legal at info@orbitlegal.co.uk or 0115 6777095.

Comments